Sequim School District ballots mailed today

Commissioners and voter's pamphlet lack transparency

Commissioners support bond while spreading misinformation and ignoring questions. The true cost to property owners. Will really nice buildings improve student achievement? Get engaged with Sequim Schools community information sessions, take a County survey, and vote in the Clallam Conservation District election.

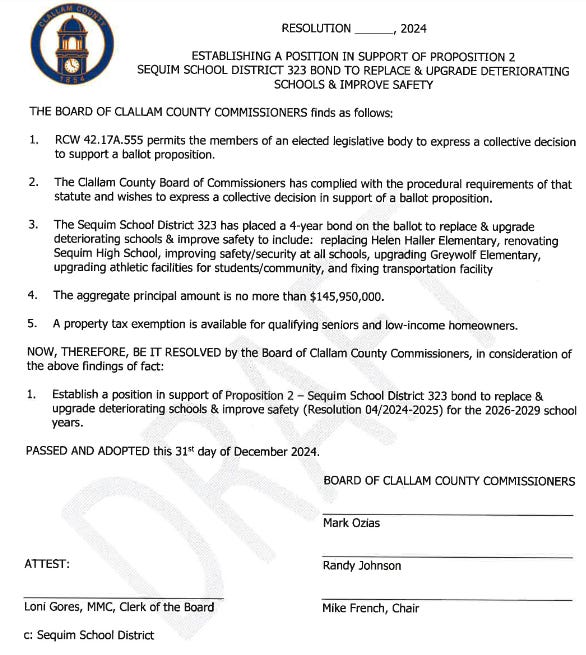

Ballots for a proposed 20-year $145,950,000 bond are being mailed to voters in the Sequim School District today. If 60% of voters approve, the bond will replace Helen Haller Elementary, renovate the high school, improve safety at all district campuses, upgrade Greywolf Elementary’s cafeteria, and repair the bus barn. Bond supporters say, “We are at a crisis point with our deteriorating and educationally outdated schools.”

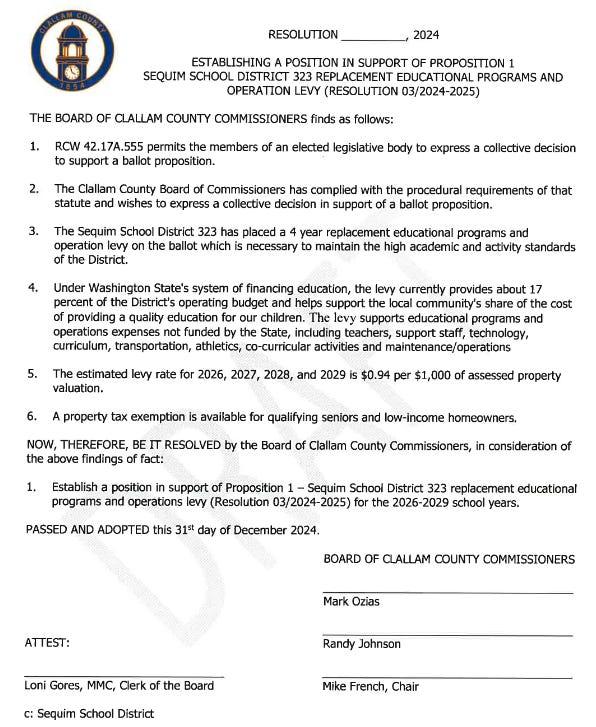

In December, after viewing a presentation from Sequim School District, County Commissioners unanimously passed two resolutions. One supported a $36.2 million EP&O (Educational Programs and Operations) levy, which covers costs not supported by state funding, such as nurses, counselors, music programs, and the annual superintendent’s $241,960 base salary.

The other resolution passed by the commissioners supported the $145,950,000 bond.

A hunt for answers

Eric Fehrmann, a regular attendee to commissioner board meetings, doesn’t argue that school facilities are outdated and need repair. Still, he had some simple questions for his county leaders who had voted to support another government agency raising his taxes.

The first question regarded the bond that the commissioners unanimously supported. Fehrmann sent the following email to all three commissioners and County Administrator Todd Mielke:

“I believe that in keeping with stated mission of transparency, it is incumbent on you to fully inform the public of the provision in Section 4 of Proposition No. 2 from the Sequim School District stated below. I would like clarification on the highlighted portions below. It appears to me that once these bonds are issued, the Board of Directors of Sequim School District No. 323 will be able to levy property tax in any amount necessary.”

Fehrmann included the following, which he found on the school district’s website:

“Each series of the Bonds… shall be paid by annual property tax levies sufficient in amount to pay both principal and interest when due, which annual property tax levies shall be made in excess of regular property tax levies without limitation as to rate or amount; and shall be issued and sold in such manner, at such times and in such amounts as shall be required for the purpose for which each series of the Bonds are to be issued, all as determined necessary and advisable by the Board and as permitted by law.”

“Pending the issuance of any series of the Bonds, the District may levy excess property taxes to repay those Bonds…”

To Fehrmann, who lives on a fixed income, the part referring to paying interest by annual property tax levies without limitation confused him. He wanted to ensure that tax rates wouldn’t be raised if revenue from property tax declined due to economic conditions or any other circumstance.

Commissioners Johnson and Ozias ignored Fehrmann’s questions.

Administrator Mielke responded and explained that while repaying the bonds, people may change how much they pay in taxes. For example, seniors could seek a property tax exemption or reduction. While that would lower the amount an individual pays for the school bond, their tax burden would be shifted onto other property tax owners.

In another scenario, new homes could be built in Sequim, and an empty acre of land that contributes very little property taxes today could have a million-dollar house on it 10 years from now — that property would contribute much more, easing the tax burden for others. The formula is constantly adjusted over the decades while the bond is paid off.

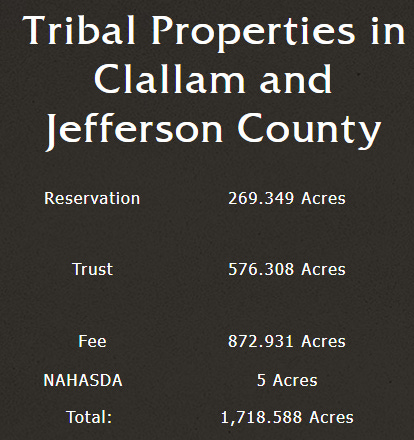

There’s another factor to consider when paying property taxes in eastern Clallam County, and it doesn’t involve property being developed or increasing in value; it involves property that vanishes from the tax rolls.

The Jamestown Tribe owns properties and pays taxes on much of them, but when that property is converted into trust status, it ceases paying property taxes to fund our school bonds and levies, and that tax burden is shifted onto remaining property owners. In 2023, the Tribe moved 258 acres off county tax rolls and into trust status. Clallam County’s draft Hazard Mitigation Plan acknowledged that the Jamestown Tribe’s “intention is to move property to reservation and trust status in the future.”

Fehrmann also told the commissioners that the amount printed in the voter’s pamphlet, $145,950,000, lacked transparency because it didn’t include the interest taxpayers would pay on that loan. Commissioner French responded to that concern:

“You are incorrect. Section 1(c) sets the amount they would be allowed to levy at ‘no more than $145,950,000’… The $145.95 million is the total of principal plus interest.”

However, Commissioner French was incorrect.

The interest is interesting

Two weeks after Eric Fehrman began asking questions of his county leaders, Sequim School Superintendent Regan Nickels did something Commissioners Johnson and Ozias refused to do — she answered a question. Then she did what Commissioner French was unable to do: she answered it accurately:

“Financing costs are not included in the bond amount. State law requires school districts to list the ‘Par’ maximum on the ballot, similar to how homes list the sales price and not the total plus interest on the market. However, all of the interest has been included in the tax rate estimates presented to the school board and community.

“Using today’s market yields we could see total interest payments be between $95MM up to $110MM over 20 years. Interest rates are competitive for school districts and are significantly less than residential mortgages. The school district does anticipate receiving investor premiums (investors willing to pay an additional amount over par to own these bonds) which are estimated to be $10MM and would be utilized to reduce the bond amount to $135,950,000 if received.”

Note: “MM” is a common abbreviation for million.

In other words, the amount property owners will pay if the bond is passed could be $110 million more than the amount published in the voter’s pamphlet. The bond amount is $146 million, but it could be a quarter of a billion dollars with interest.

Superintendent Nickels is right; the sale price for a home on the market does not include the mortgage’s interest, but a lender’s amortization schedule generally shows the total amount paid in principal and interest over the years of the contract.

If District 3 Commissioner Mike French doesn’t know that interest is not included in the bond amount, he shouldn’t be influencing voters in District 1. Similarly, if Commissioners Ozias and Johnson support ballot propositions that cost their constituents hundreds of dollars, they should answer basic questions about the tax increases.

How much will it cost?

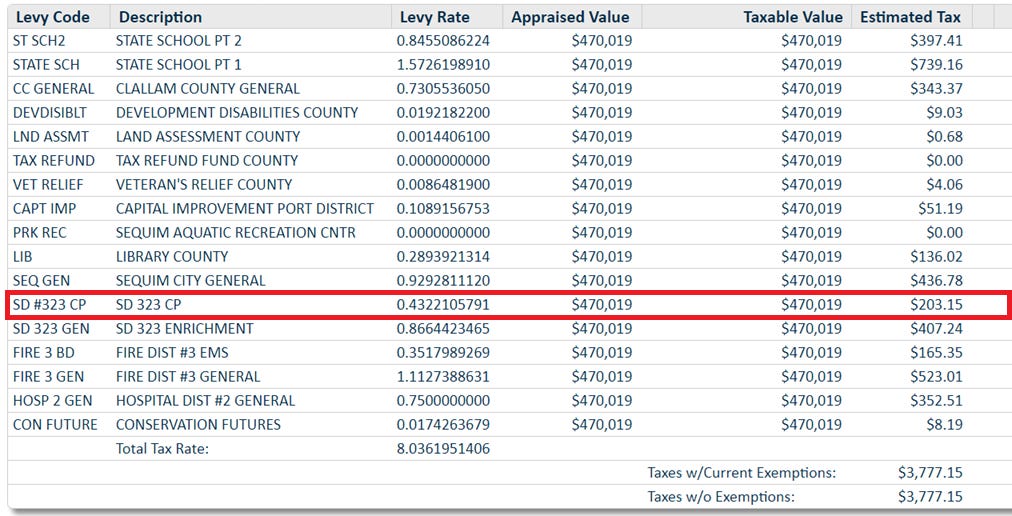

Right now, property owners within the Sequim School District’s boundaries pay $0.42 per $1,000. The proposed bond rate would more than double that amount to $0.91 per $1,000. “If passed, this will be a tax increase of under $20 per month, based on a $470,000 median home value,” the pamphlet reads.

The example below is a property within the Sequim School District with an assessed value of $470,019, which is the median home value, according to the voter’s pamphlet. This property owner pays $203.15 yearly for School District #323 Capital. That’s in addition to the $397.41 and $739.16 paid to the state for schools and the $407.24 paid for the EP&O levy. Half of this property owner’s taxes fund education.

Adding $20 per month, or $240 per year, will more than double the amount the property owner currently pays for “SD 323 CP” — that could be a nearly $5,000 increase during the 20-year contract to pay off the bond.

How are our students doing?

Fehrmann wants Sequim Students to be successful in life, but he wonders if there is enough focus on education. “I just don’t want failing students to come out of really nice schools,” he said.

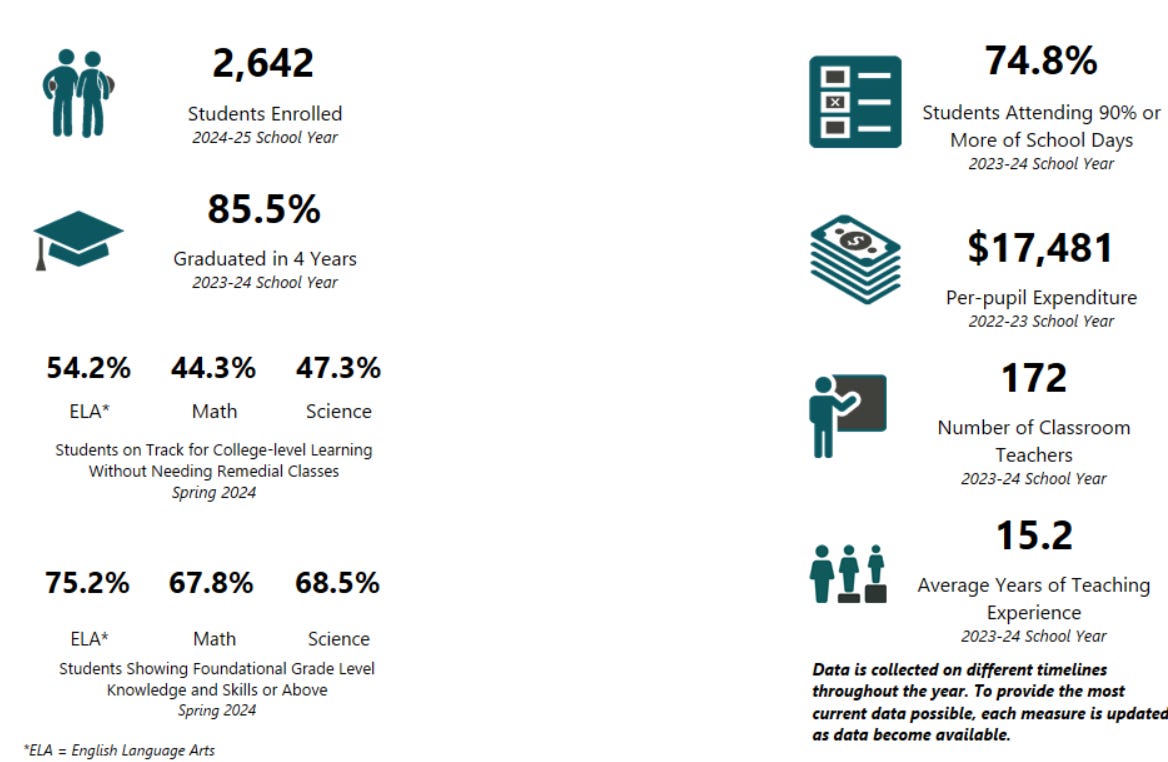

Sequim School District’s report card is available on the State’s Office of Superintendent of Public Instruction website. During the 2022-2023 school year, $17,481 was spent per student. Depending on the subject, students on track for college-level learning ranged between 44.3% and 54.2%. Students showing foundational grade-level knowledge and skills ranged between 67.8% and 75.2%.

Many voters are unaware of the true amount being asked of voters for the special election on February 11th. Clallam County Watchdog doesn’t support or oppose the levy but does support transparency.

Become engaged

Schools

The Sequim School District will hold three more Community Information Sessions:

January 23 @ 7:00 pm in the Sequim High School Library

January 28 @ 9:00 am in the Board Room

January 30 @ 1:00 pm in the Board Room

Clallam County Comprehensive Plan

Clallam County wants to hear from residents about future growth, housing, climate, and more. Click here to take the community survey.

Clallam Conservation District

The Clallam Conservation District (CCD) will hold an election for its Board of Supervisors this year. The CCD plays an influential role in piping irrigation ditches, determining the benefits of the future reservoir south of Sequim, and metering private wells. All Clallam County registered voters are welcome to vote, but you must request a ballot by February 21st. You can do so by clicking here.

If a measure only affects land owners taxes, then only the land owners affected should get to vote on it.

Thank you, Jeff and Eric!! This bond is another burden that property owning taxpayers will be enslaved to pay. There are many counter points to this bond issue, but I think Eric found the main point - THE REAL COST. How many times have voters been told, "It's only going to cost...." and then, "Oops. We miscalculated. We need more money." We need schools that teach STEM, reading, writing, p.e., art, music, and financial responsibility. Yes, buildings need to be safe, clean, and functional. But I want to see an improved academic report card from the School Board before they can ever propose another bond.