This week, Commissioner Mike French joined representatives from the arts, culture, and heritage communities in persuading the Board of Commissioners to support a 1/10th of 1% sales tax increase. The tax would fund a Cultural Access Program (CAP), supported by the Washington State Arts Commission, which offered to manage the program for a percentage of the estimated $1.8 million in revenue the tax could collect.

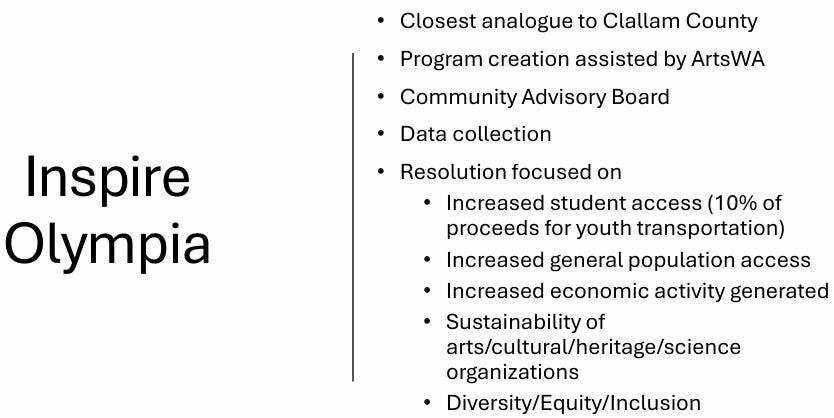

Commissioner French had prepared a slide presentation promoting the tax’s community benefits. If passed, he intends to model the program after the City of Olympia, whose revenue is comparable to that which Clallam County would receive. Olympia passed the tax via ballot measure by 58%.

One of these economies is not like the other

Clallam County would be the fourth jurisdiction in the State to impose such a tax; Olympia, Tacoma, and King County are already taxing their populations. However, there are stark contrasts between those taxation pioneers and Clallam County.

According to Washington REAP, when it comes to a county’s Gross Domestic Product (GDP), which is a measure of economic health, King County is second in the state with 22% growth, Thurston County (Olympia) is 12th at 10.5%, Pierce County (Tacoma) is 15th at 9%, and Clallam County’s GDP is 26th of 39 counties at 6%.

Looking at annual per capita income, King County dominates with $113,819. Pierce and Thurston Counties are both at about $59,000, and Clallam County lags at $55,566.

Regarding employment growth, King County is second, Thurston County is fifth, Pierce County is seventh, and Clallam County is near the bottom at 34th.

By any measure, Clallam County’s economy is far behind other jurisdictions that have supported a tax to sustain arts, culture, and heritage, and Commissioner Randy Johnson knows it.

“I think about our time, not only our current budget and all the issues going on, I also think about what I consider to be some real basic needs,” began Commissioner Johnson. He mentioned the Fire District #2 levy that recently failed and then talked about the Port Angeles School District, which “has a major hole and has a major need for buildings that haven’t been refurbished since the sixties.” Johnson said he has difficulty reconciling the sales tax increase, but if the Board considers this, “it absolutely must go out to the people for a vote.”

Option to bypass voters

French said, “Philanthropy doesn’t have a democratic component. Again, I think it’s great that we have a generous community that wants to program their philanthropy dollars to different things, but with a public program, there is a democratic component where the public gets to choose what they want to see.”

Direct democracy would allow the people to decide if they want to be taxed. However, nonprofit leaders are pushing for the Board of Commissioners to instate the tax without a vote of the people. The Board has the option to put the tax into effect through a councilmanic process — a tool that would bypass voters and rely on a majority vote of the three commissioners.

David Herbelin, Executive Manager of Olympic Theater Arts in Sequim, explained that the councilmanic process was included in the bill because “These organizations that are relying on donations to just pay their bills, they don’t have the money to support a campaign.” Herbelin told the commissioners, “You’re saying that these organizations that are basically barely able to make it, you’re saying that you want them just to go out there and put money into advertising for signs to get this approved — it puts them further in that hole.”

The newly opened Field Arts and Events Hall on the Port Angeles Waterfront has recently received $300,000 in taxpayer funds from the American Rescue Plan Act (ARPA) and just under $600,000 from the County’s Lodging Tax fund. Last week, the organization was hoping to get an additional $50,000 from ARPA for construction and debt payments.

Executive Director Steven Raider-Ginsburg explained why voters should be bypassed when imposing taxes. “We get dozens of requests a week for free space, for subsidized tickets to support youth programs,” said Raider-Ginsburg during public comment on Tuesday. “It is a huge need, and we are doing our best to fulfill each and every request that we can, but we can’t go out and fulfill all those requests without support.” He finished by saying, “This is a no-brainer win for economics and quality of life.”

Philanthropic risk

Director Herbelin explained that organizations currently rely on two sources: volunteers and donors. “If either one of these streams dries up, that organization is gone.”

Commissioner French echoed Herbelin and emphasized the need for these programs to be sustainable. “There’s a reliance on philanthropy,” he said. “That’s not a bad thing. I’m not here to talk negatively about philanthropy, but that does give all these organizations, it presents them with a risk where they change their focus to chase philanthropy dollars, to chase grants from those organizations, or to chase private dollars, and that’s a risk for their sustainability.”

Funding nonprofits with tax dollars doesn’t necessarily ensure sustainability. The Olympic Peninsula Humane Society's (OPHS) current financial deterioration is a prime example. According to IRS filings, OPHS had an estimated 230 volunteers last year—a solid philanthropic commitment from the community. However, the animal shelter is failing despite contracts with the Cities of Sequim, Port Angeles, and Clallam County.

The County’s contract with OPHS, worth $125,000 per year, revealed that the commissioners unhesitatingly dole out taxpayer money without investigating the financial health of organizations that enter the boardroom looking for a handout. Without stewardship or oversight, there is no accountability. OPHS has taught us that without accountability, there can be misuse of funds, inefficiency, and loss of public trust. It has all led to decreased services to the public.

The OPHS price-per-kennel ballooned to $3,000 per animal, and locals were shocked to learn that when they donated $100 to OPHS, according to tax filings, only $6 went directly to animal care. Annual employee compensation passed $700,000 last year, and OPHS employment increased to 50 positions.

In a survey circulated to eight Clallam County arts, culture, and heritage institutions, over half answered that they would use the money to hire staff or increase hours.

Mixed support

Commissioner French suggested that a sales tax hike won’t impact county residents the most. “I’ll remind people that tourists pay into the sales tax,” said French. “So, a good chunk of the tax revenue we generate with the sales tax like this, or the affordable housing tax, comes from visitors.”

French further explained that the difference between this new tax and previous tax hikes, like for affordable housing, is that “It would create programs that would have a benefit to everyone in the public. So that’s the very big difference with this.”

Commissioner Johnson disagreed. “I would argue housing creates a great big benefit for everyone in this community.”

“I think there’s clearly a need [for the programs funded by the tax],” said Commissioner French. “We really want to re-engage our youth, especially after what they’ve gone through with Covid.” French explained that part of the funding should be dedicated to transporting school children to cultural and heritage activities. When the sales tax increase was first presented to the commissioners in July, French imagined the tax could fund a program operated by the Salmon Coalition to teach children to fish — an activity that would likely require transportation, hence the need to fund it.

“I think that this would be appropriate to put out on a ballot to ask the voters to consider whether they would want to tax themselves for this purpose or not,” said Commissioner Mark Ozias of that tax that, when first presented to the commissioners, included drama and art therapy for incarcerated populations.

Then Commissioner Ozias revealed, “I personally would be happy to help advocate for it… I’d be willing to help participate in an advocacy campaign.”

And that’s one of the fundamental problems with the Clallam County Commissioners.

Losing sight of their vision

The commissioners’ first mission objective is “Putting the translated desires of our residents into action through effective communication.”

However, we repeatedly see the commissioners putting the translated desires of organizations and special interests into action through effective propaganda. The examples are piling up:

When hospital CEO Darryl Wolfe solicited support for Olympic Medical Center’s levy, rather than telling him what their constituents desired from a functioning hospital, the commissioners drafted a letter of support for his failing business, encouraging constituents to support the levy that would double their taxes.

When residents came to the commissioners with concerns about Peninsula Behavioral Health’s runaway costs for their new $12.75 million luxury apartment building for the homeless, the commissioners didn’t bring those concerns to the agency’s leadership. Instead, Commissioner Ozias sent an email reminding residents that the agency “has proven their ability to shepherd and manage this kind of project effectively.”

Last fall, when the Commissioners held a public meeting about Towne Road, they promoted the recreational aspects if it remained closed. They omitted the catastrophic consequences of hindering a tsunami evacuation route and hid that emergency response times and home insurance rates would drastically increase. The Board of Commissioners had embraced an agenda belonging to special interests and propagandized it to the public.

The commissioners have repeatedly used their platform to push the agenda of special interest organizations onto the people when it should be the other way around. In the current system, the people are without representation.

Taxes collected but not remitted

The front page of the Jamestown Tribal Newsletter from February 2022 is dedicated to that year’s purchase of “Sequim Trading Plaza” on the corner of Washington Street and Sequim Avenue. That block has businesses such as Hurricane Coffee, Bauer Interior Designs, Cedarbrook Lavender, Pacific Mist Books, and other retailers who lease space from the Tribe.

The newsletter reads, in part, “An application to convert these properties from fee to trust status is underway.” That means these properties could soon be off the tax rolls, and Clallam County would lose over $16,000 in property tax revenue, further shifting the burden of funding essential services onto taxpayers.

The newsletter also said, “The Tribe, along with all of the State’s other Tribes, is in the negotiations process on a compact to allow Tribes to collect the sales tax collected by non-Tribal businesses on Tribal lands. This would mean additional revenue for Jamestown.”

This would also mean that if you bought a treat at Hurricane Coffee or new window treatments at Bauer Interior Design, you would pay sales tax as you do now. However, that tax wouldn’t go toward the County’s general fund, affordable housing, or a Cultural Access Program… it would go into the Tribe’s pocket.

What if the commissioners represented the People?

What if, when the community of Dungeness had lost direct connectivity to the west side of Sequim via Towne Road and had already witnessed fire trucks detour five miles to respond to a fire that left a family homeless, Commissioner Mark Ozias had listened to community concerns. What if Ozias had presented a slide show to his fellow commissioners that promoted the benefits of keeping a public road open to the public? What if he had urged them to complete the road, instead of trying ten times to stop it?

For one, millions of taxpayer dollars wouldn’t have been wasted.

What if Commissioner Randy Johnson had listened to constituents who thought paying $350,000 per apartment for the homeless was frivolous? What if he hadn’t rubber-stamped the resolution that handed another $2 million in tax funding to an agency with a poor track record of building within a budget?

Closely examining project details could have saved county taxpayers hundreds of thousands and increased the capacity for others awaiting housing.

What if, instead of giving a presentation showing how a new tax would benefit agencies, Commissioner Mike French had watched a presentation prepared by the agencies? What if French responded to the presentation by saying, “I’ll check with my constituents before making my recommendation” instead of wholeheartedly endorsing a tax hike and pledging to advocate for it?

Two things would happen:

This county wouldn’t be on the brink of financial ruin.

The residents of Clallam County would have representation.

The commissioners told the interested organizations that they would likely revisit the topic of a sales tax increase in October after focusing on next year’s preliminary budget.

“We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” — Winston Churchill

I'm curious about the chances of heritage organizations like Daughters of the American Revolution or Sons of Norway receiving funding from this.

Philanthropy is demonstrated by gifting. I choose to whom I gift. Commissioner French chooses to gift to the arts. His choice, not mine. Taxpayer dollars are not gifts. This tax increase needs to go to the voters: Democracy, not philanthropy. Watching the proponents of CAP plead their program to the Board (including Comm. French) , I observed them to be anxious and hasty. Did they not expect push-back? Jeff, you have given our community a great gift: Your time, energy, and dedication to accountability. I thank you and appreciate you. Clallam County, pay it forward.