County economy struggles while one corporation thrives

"Self-reliance" redefined to include taxpayer-funded grants and exemptions

Clallam County’s economy is floundering. Radio Pacific broke the news that we have one of the lowest median household incomes in the state — 28.5% below the state average, and it’s getting harder not to notice.

The Humane Society recently announced its financial implosion. Arts and culture organizations are courting the county commissioners for a tax hike. Voters didn’t approve a bond measure, so the Sequim Library had to settle for a $10 million remodel (and is asking for donations). Fire District #2 is asking residents for a levy lid lift, and even the county’s largest employer, Olympic Medical Center, is asking taxpayers to double their giving as it loses millions every month.

The pain isn’t over yet — nearly 200 employees are working their final three weeks at the soon-to-be-shuttered McKinley Paper Mill, and the Port Angeles School District is rolling out its 30-year plan of bond and levy measures, which starts with the $67 million investment in Stevens Middle School (a project that recently pivoted from a remodel to new construction).

However, one corporation, the county’s second-largest employer, isn’t struggling. According to its CEO Ron Allen, the Jamestown Tribe is so flush with money that it is in a position to manage the Dungeness National Wildlife Refuge and begin a commercial oyster farming operation. In an interview with KONP, Allen said he “believes it’s a good deal for all because the Tribe has access to multiple sources of funding that the USF&W does not.”

As reported in the Winter 2023 edition of Living on the Peninsula, Allen said the Tribe’s businesses — which range from the casino and gas station to a golf course, excavation company, concrete work, and even self-storage — bring “way in excess of $100 million” annually.

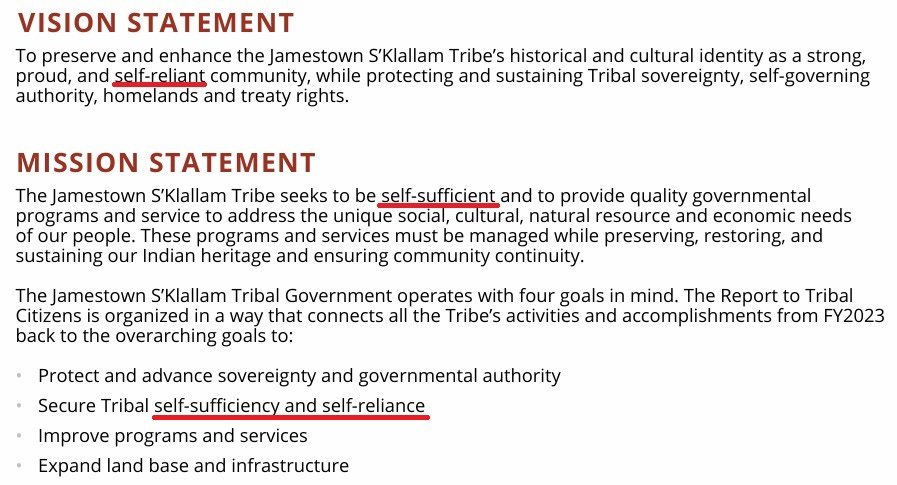

That’s an impressive revenue stream for an economically depressed region, and it aligns with Jamestown’s goal of being self-reliant.

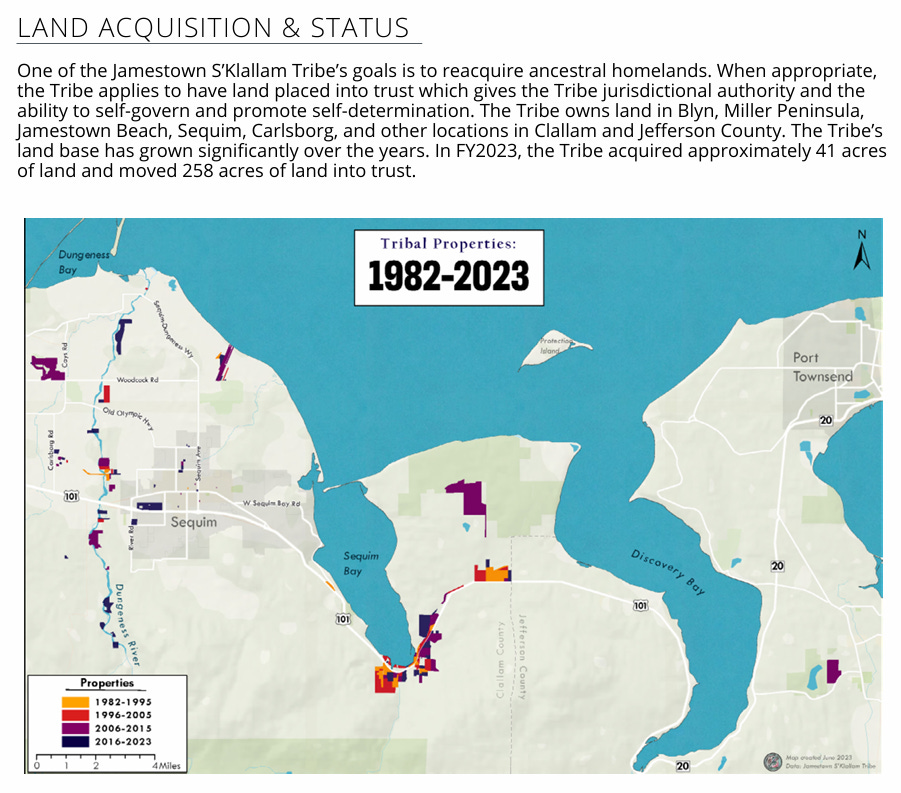

The Jamestown Tribe’s goal of achieving self-reliance is aided, in part, by not having to pay property tax on parcels that are converted into tribal trust land. That means that the burden of funding essential services such as our hospitals, fire districts, and veteran aid is increasingly shifted onto the remaining property owners in Clallam County. Last year, the Jamestown Tribe converted an additional 258 acres into tribal trust land — more than double the 117 acres transferred in 2022 — further defunding our county’s schools, libraries, and roads.

More tax exemptions may be coming to tribal enterprises and community members. According to the Tribe’s annual report, “Tribal Staff continue to work with the Department of Revenue to find a resolution to off reservation sales by Tribal Citizens in the service area. The Tribe continues to push that these sales should not be taxable in situations where the Tribe does not have housing on the reservation. Staff have also worked with the Social Security Administration to fight for tribal assistance programs not affecting Tribal Citizens’ social security benefits. Chairman Allen continues to also fight this battle with Department of Treasury.”

In other words, it appears that the Jamestown Tribe doesn’t want its businesses or tribal members to pay property taxes, sales taxes, social security taxes, income taxes, or any other tax — this would require a change at the federal level. Chairman Ron Allen is a Tribal representative in the Department of Treasury Internal Revenue Service.

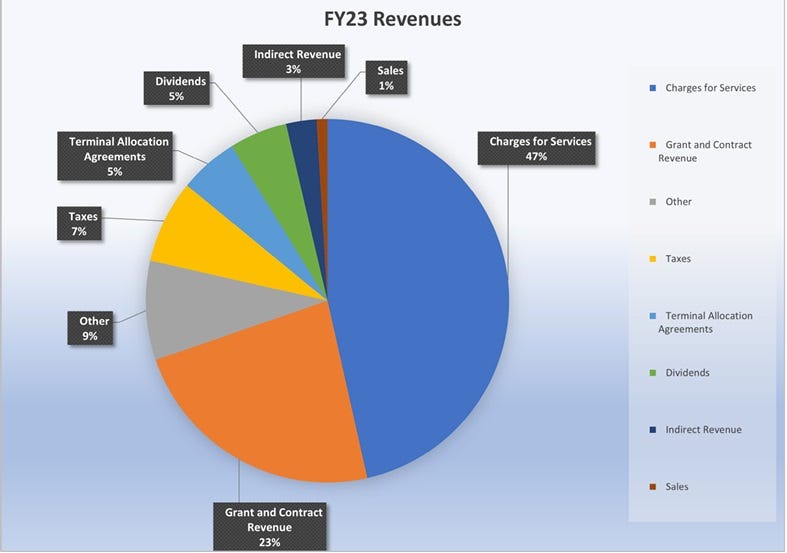

Last year saw an increase of $4.5 million in revenue for the Tribe, whose pursuit of self-sufficiency saw $16,461,276.74 in taxpayer-funded grant money flow into the corporation’s coffers. While the county’s hospital lost $28 million, and economic headwinds buffeted an ailing mill and countless businesses, the Tribe made an impressive $70,855,177.40 in revenue.

The annual report mentioned that “grant revenues in total decreased because there were no significant COVID funds awarded in FY2023.” In 2020, the US Department of the Treasury began giving COVID relief payments to tribal governments in three installments. During a time when the City of Sequim used its “Rainy Day Fund” to extend a lifeline to 58 small businesses struggling through the pandemic, the Jamestown Tribe received $8,522,365.60 in COVID relief funding.

Restaurants were forced to close, but the casino remained open — not because the virus wasn’t transmissible in Blyn, but because sovereign nations don’t have to follow state mandates. That taxpayer-funded COVID relief giveaway equates to over $16,000 for every Jamestown S’Klallam tribal member, of which there are 519, or nearly $40,000 for each of the 217 tribal members living locally.

When the pandemic first began disrupting our economy and health, the Tribe was the first to receive taxpayer-funded vaccines. After vaccinating tribal members, other area residents were allowed to receive the vaccine their tax dollars had funded. The Jamestown Tribe led an expertly organized drive-thru vaccine operation that set a nationwide example for others to follow. Sequim residents were told by their county commissioner, Mark Ozias, that his top campaign donor had done this for the community out of pure benevolence.

However, the city of Sequim communicated that the Tribe made a handsome profit from vaccinating locals.

It’s important to understand that the Jamestown tribal members are integral and respected community assets who have made valuable contributions to society. However, the Jamestown S’Klallam Tribe is a revenue-generating corporation, and its “Report to Tribal Citizens” makes that clear. Reviewing the 64-page document reads like any other annual report from a profit-driven corporation:

“Revenue levels saw a 4% increase for the entire organization with the Health Department seeing considerable growth with the opening of the Jamestown Healing Clinic.”

“The Jamestown Family Health Clinic (JFHC) has smoothly transitioned from COVID back to the focus of primary care and improving patient outcomes. With several new medical providers, the Clinic is at or near full capacity and set a new one-day patient record of 303 appointments. There were many achievements over the last year including: EPIC 9 years – Top 10% Financial Heartbeat, Increased Medicaid reimbursements to $654 per encounter; Medicare Federally Qualified Health Center (FQHC) to $180 per encounter.”

“Evaluation and Treatment Facility (Sequim): Washington Legislators earmarked $13 million in 2023-2025 capital construction budget (Senate Bill 5200) for the project to build a 16 bed/18,000-square-foot evaluation and treatment inpatient facility. The evaluation and treatment facility (E&T) would serve people in crisis, with patients seeing an average of 10 to 14-day stays. The Tribe is in a unique position to manage the facility but is not funding it with Tribal dollars. The estimated cost is $26 million, with state funding expected in the next biennium. Construction is expected to start in 2024 and patients will be residents of Clallam and Jefferson Counties.”

“This year on Miller Peninsula we have focused more on the Travel Center/Gas Station project that will accommodate big rigs, boats, consumer sized and electric vehicles. We have just started clearing the land and will start predevelopment in 2024.”

“2023 tax revenues include cigarette, fuel, sales tax, and hotel tax. These taxes totaled $2.9 million dollars for this year through September. It is estimated the total taxes for 2023 to be approximately $3.8 million dollars.” (Note: while the Tribe collects taxes, those monies are retained by the Tribe and not remitted to the State as non-tribal businesses are required to do).

According to a recent meeting with US Fish & Wildlife, the Jamestown Tribe will receive approximately $500,000 annually to manage the Dungeness Spit and Protection Island. In addition, the sovereign nation will bring additional US taxpayer dollars that federal and state governments can’t access.

Allen said in the KONP interview, “If anybody’s going to do shellfish farming and protect the habitat and the environment for the purposes of wildlife, bird life, etc., we’re the best stewards around.” No examples were provided of the Tribe providing better stewardship than the US Department of Fish and Wildlife currently offers.

Examples of the Tribe’s environmental stewardship may be in the casino, hotel, and 500-car parking lot built in a salt marsh estuary. Possibly, it’s the cannabis dispensary and 12-pump gas station on the banks of salmon-bearing Jimmycomelately Creek. The Tribe fertilizes and mows an 18-hole golf course and driving range, bisected by a tributary to Matriotti Creek, a riparian habitat rich in biodiversity such as trout and spawning salmon. The hundred-plus acre championship golf course is kept verdantly green despite a state-wide drought declaration and irrigation restrictions imposed by the Tribe on local water users.

We know that the Jamestown Tribe considers the management of The Spit and Protection Island to be a “good deal for all,” and we know the Tribe is the “best steward around” because the Tribe says so. We also know that the Tribe has ways to get federal taxpayer money that federal agencies can’t get. We know the Tribe can do it without following the rules and regulations imposed on others. And we also know the Tribe can do it all with public funding but without public knowledge or input.

In a virtual meeting with US Fish & Wildlife Director Sarena Selbo, it was made clear that the ink is already dry on the agreement to hand over management of the Refuges to the Jamestown Tribe even though it won’t be signed until August 16th.

Clallam County Watchdog depends on engaged, vigilant subscribers for tips and research. This article would not have been possible without Kathy Trainor's invaluable assistance. Kathy, thank you.

Well well well - once again Mr Tozzer you expose another pesky issue - HOW much MONEY does the tribe NEED? I wonder ! Stay Pesky!

Excellent write up, Jeff. The biggest thing I think we all need to wrap our brains around is the tax issue. We shouldn’t be upset that the Tribe isn’t paying the same amount of taxes as the rest of us. We should be upset that we are not paying the same amount of taxes as the tribe. You want to even the playing field don’t make them pay more taxes, make everyone else pay less. It’s all those tax dollars sloshing around that are the source of almost all the problems you’ve had to uncover here at CC Watchdog. More tax money obviously isn’t going to fix the corruption and incompetent management of OMC, the school districts, and county government. I think most people would have a hard time understanding this but I believe we are at time when a complete shake up of how we build our communities is at hand. The old way of more taxes given to incompetent and corrupt bureaucrats is over. We need to follow the lead of the Jamestown S’Klallam Tribe, unchain the hands of the economic producers and allow them to grow our communities along side the Tribe as equals.